The problem with Static DCF and Discount Rates

Discount Rates Include:

-Risk Free

-Market/systematic risks (beta and risk premium)

-Time value of money

-DLOM

-Size

Is that enough for this case?

Discount Rate Adjustment Technique

The problem

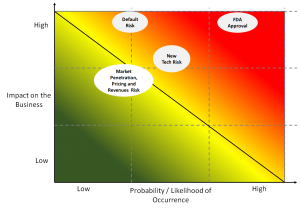

The single and base scenario assumes success with expected revenues, so it is conditional with no probabilistic assessment. Variables are not subject to volatility as it should be in reality. A static DCF is not considering following scenarios

-FDA approval,

-Risk of Failure,

-Probability of New Technologies affecting Revenues ,

-Probable Market Penetration,

-Other specific Risks

Discount rate must therefore be adjusted (estimated) to capture all those risks but HOW??