Real Estate

Real Estate

We offer many services to support the decision making process in the real estate sector. Our advanced Monte Carlo based techniques allow us to deliver strategic, economic and risk modelling solutions as well as advanced quantitative approaches, including:

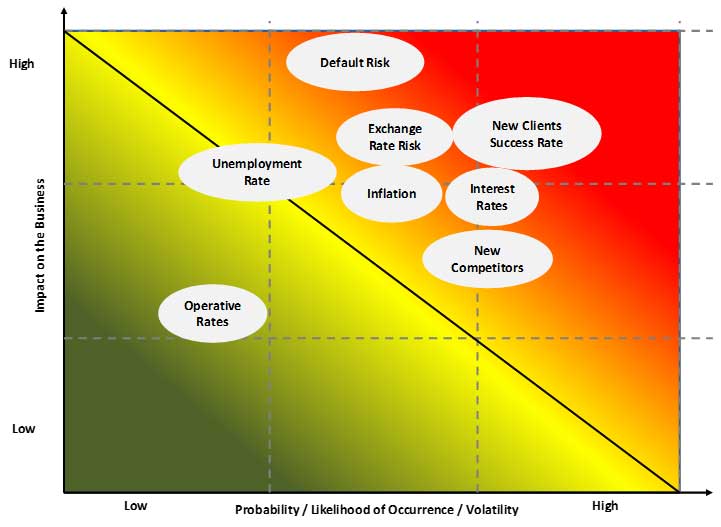

Analysis of the economic cycles forecast and their influence on the real estate project

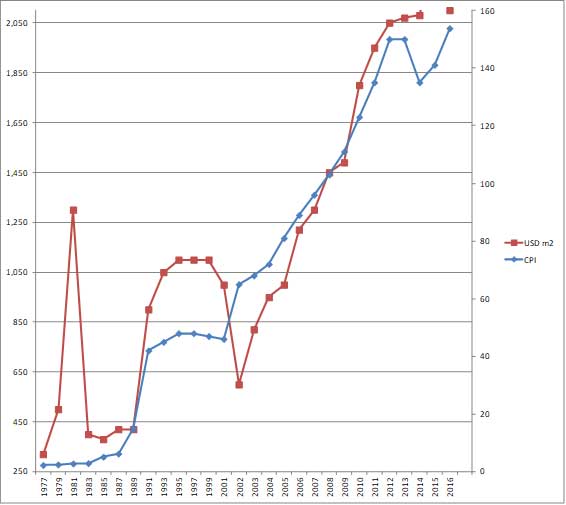

Correlation analysis between macro economic drivers influencing the price of m2: Inflation, devaluations, interest rates, access to credit, etc as shown in the figures below.

As a consequence, we are able to determine the probable future value of the property. We use uncertainty and probabilistic scenarios based on macro economic drivers at risk (with volatilities and standard deviations) and correlation analysis

Sectors

Looking for a first-class business plan consultant?

London

78 York Street

London, UK, W1H 1DP

Switzerland

Rue de Genève 18

Case postale 306

1225 Chêne‑Bourg

Switzerland

Malta

6 Sir William Reid Street, Gzira, Malta