Mining

Mining

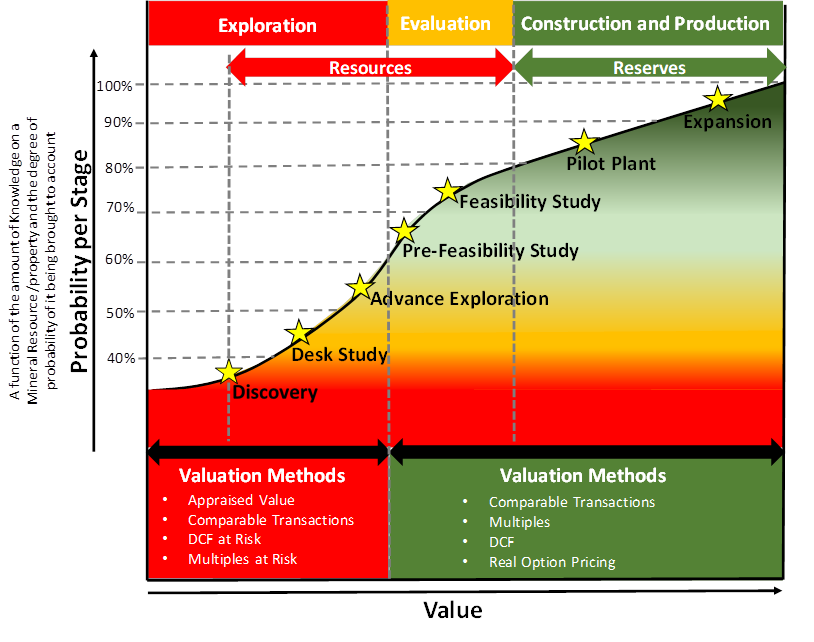

We offer many services to support the decision making the process of the Mining Industry during all its stages of development (fundraising, Discovery, Desk Study, Advance Exploration, Pre-Feasibility Study, Pilot Plant, and Expansion). Our advanced Monte Carlo based techniques allow us to deliver strategic, economic and risk modelling solutions as well as advanced quantitative approaches, including:

- Mining projects need to consider the probabilities of each stage of development from discovery to expansion.

- We have a long experience in all types of resources (metal, non-metallic, and rock) and manage updated and detailed data and statistics of most recent projects globally.

- Our experience includes Lithium, Coal, Copper, Silver, Zinc, Gold, chrome, Fe-Ni, Ni-Si, Limestones, Baoxide, Quartz, Gypsum, etc. We also have a unique focus and expertise on Lithium projects.

- Price forecasting using volatilities and standard deviations based on history and market expectations based on upstream markets

- Uncertainty analysis of all Macro economic and political scenarios that may affect the business (specially in emerging countries)

- Optimisation of resource deployment and of asset portfolios using kurtosis, skewness and standard deviation analysis.

- We use tools for complex decision-making like Monte Carlo Simulation, Real Options, and Bayesian techniques.

- Portfolio sizing and optimisation (e.g. optimal sizing of for E&A portfolios, aggregate reserves calculations)

- Integrated forecasting of all stages: Production forecasting and modelling (e.g. decline modelling, operational breakdown possibilities)

- We assess and forecast uncertain macroeconomic and political events that may affect both the price or the production of our forecasts.

- We hold detailed data and statistics of recent projects and mines in different regions and sectors.

- We analyse and model drivers like technology, concentration, density, depth, infrastructure, logistics, services, etc

- Financing issues (e.g. debt modelling, project finance, supporting of equity raises, use of non-conventional financing techniques)

- Advanced valuation techniques (combining cash flow, uncertainty analysis, real options, etc).

Sectors

Looking for a first-class business plan consultant?

London

78 York Street

London, UK, W1H 1DP

Switzerland

Rue de Genève 18

Case postale 306

1225 Chêne‑Bourg

Switzerland

Malta

6 Sir William Reid Street, Gzira, Malta