Our Products

Advance Multidimensional Valuation

Long term forecasts are stochastic and driven by volatile variables. Our valuations are aimed at improving both value and strategic decisions at any stage of the business. It is also for businesses committed to protect and create value.

For Private Equities, Companies, CEOs, COOs, CFOs, CROs, and analysts needing support in the elaboration of advanced Monte Carlo based stochastic models aimed at managing business variables and risks at a much deeper level. :

Our consulting experience in issues relating to strategy, risk, and advanced valuation, have given us a multidimensional understanding of complex business behaviour and patterns which allow us to build financial models with a unique value as a decision making tool. We use this experience to provide financial model advisory services and customized training on specific topics. Generally, a short planning engagement is sufficient to define the key decision-support requirements of a modelling process, and design the overall model architecture in the appropriate way. The process will depend on the needs of each client but the complete service includes:

Income Approach

Our Preferred Method Multiple Period and single Period Discounted Cash Flow Allows to explicitly model return and operating assumptions Can Accommodate advanced simulations techniques such as Monte Carlo.

Market Approach

With the use of our Databases we can always find good comparables in terms of sector, size and region. However, this methods present some problems and we only use i t as reasonableness check for Income approach results

Asset Approach

Adjust Book Value, Liquidation Value, Also used to value GP or Holding entities in the invesment company structure that are not allocated fee income such as (carried interests)

Options Pricing Model

It assesses the best time to undertake certain business initiatives, such as deferring, abandoning, expanding, staging, or contracting a capital investment project. This technique is very common when one value driver has a high level of volatility through time.

Advanced Multidimensional Valuation & Valuation Decisions

For Investors and Companies needing to identify opportunities and have a deeper analysis of the future potential of the company. We will tell you where you are and why and where you could be and how:

- Macroeconomic Analysis

- Market analysis

- Target Positioning and Strategic Analysis

- Risk Analysis and Assessment

- Value and Risk drivers identification and measurement using advanced techniques,

- Risk Value Flow Analysis of all the variables impacting the business

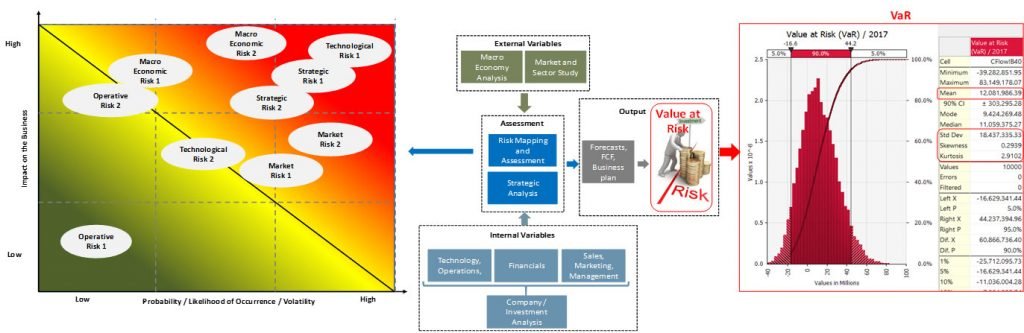

- Risk Map Analysis to assess probabilities of occurrence, volatilities and impact on the business of all variables

- V.Stochastic and Multidimensional Forecasts under different market scenarios and strategic plans

- VI.Independent Advanced Valuation using:

- DCF (Discount Cash Flows) at Risk

- rNPV (Risk adjusted Net Present Value)

- VaR (Value at Risk)

- Comparables and benchmarking Analysis

- Other Methodologies depending on the Sector and Industry under analysis

- Conclusions

- Executive Summary and Teaser

Value for Decision Making

M&A Strategic Decisions: We separate a fair market value (under accounting guidelines) from a potential restructuring opportunity value, a strategic opportunity value, and a synergic value,

Strategic Valuation and Advisory: Our final report will measure the Risk-return trade-off of your business: Is the company underperforming? Why? As a consequence, we support our clients in the elaboration of a value creation plan aimed at capturing internal and external opportunities as well as mitigating risks in order to search for alpha value (excess of return).

Predictive Analytics: The advanced model elaborated for the valuation report will remain as a company tool to review the company strategy, forecast the business, update market drivers, create valuation plans under different scenarios and improve complex decisions

THE MORE YOU SEE THE MORE YOU EARN

Quick Links

Looking for a first-class business valuation consultant?

London

Berkeley Suite

35 Berkeley Square

Mayfair, London

W1J 5BF

Switzerland

Malta

6 Sir William Reid Street, Gzira, Malta

Contact Us

- +44 (0) 7443 758262

- info@bvint.com