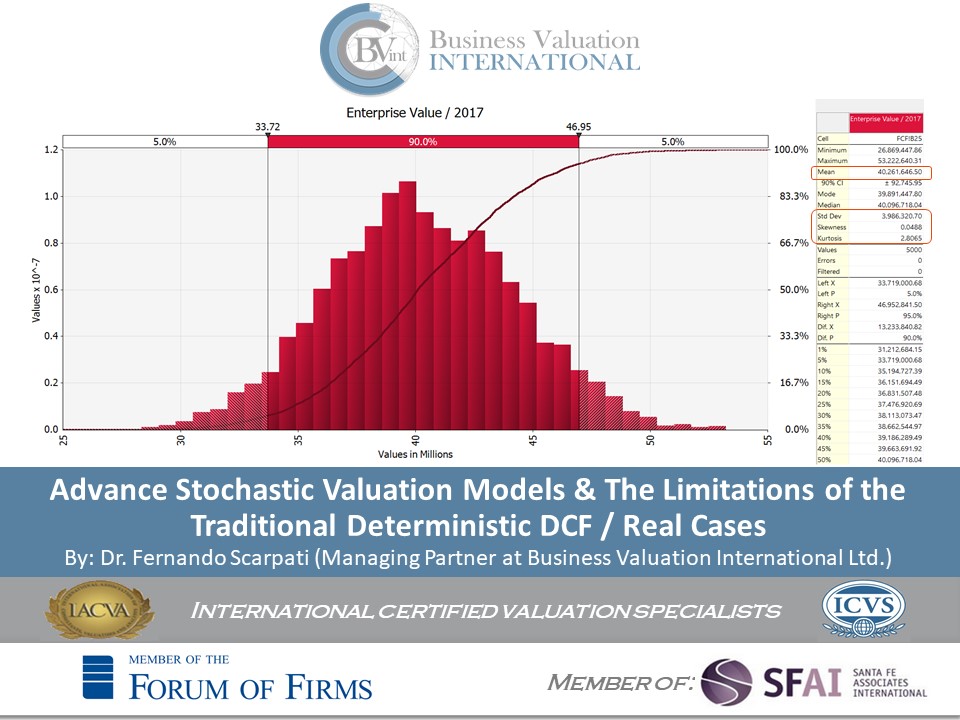

Advance Stochastic Valuations & The Limitations of the Traditional Deterministic DCF / Real Cases

The Problems of the Traditional Deterministic DCF A deterministic⁽¹⁾ DCF uses deterministic forecasts which are driven by only one scenario of variables. Valuators normally analyse forecasts using three scenarios: optimist, pessimist, and mean or they use sensitivity analysis. However, such approaches do not work with multiple variables that change in time. Additionally, deterministic forecasts and valuations […]