With the rise and emergence of new machine learning technologies, Artificial Intelligence has become an imperative for the business owners to maintain a competitive edge.

By using AI methodologies, BVint focuses on identifying and measuring the risk and value drivers accurately and efficiently. Data analytics can identify the internal and external drivers as well as analyse the issues involved in your business.

With the help of Monte Carlo simulation, we can model the behaviour and measure the impact of all risk drivers affecting your company or investment. Our forecasts reflect the true volatility of all business and market phenomena, asset values as well as the likelihood of different outputs. As a result, we can effectively support our clients in complex business decisions.

Monte Carlo simulations are used to model the probability and volatility of different outcomes in a process that cannot easily be predicted due to the intervention of random variables. Since business and finance are plagued by random variables, Monte Carlo simulations have a vast array of potential applications in these fields. They are used to assess the risk that an entity will default and to analyze derivatives such as options. Insurers and oil well drillers also use them.

– Exchange Rate Risk, – Interest Risk,

– Credit Risk,

– Commodity prices volatilities,

– Growth rates evolution at risk,

– Markets, Strategic, Operative and Technological Risks,

– Success probabilities to achieve certain goals in a given business plan,

– Start-up Risks according to the stage of development and sector,

– Other Potential Contingencies

– Management success probabilities in implementing a given strategy according to academic studies and past performance

– Etc

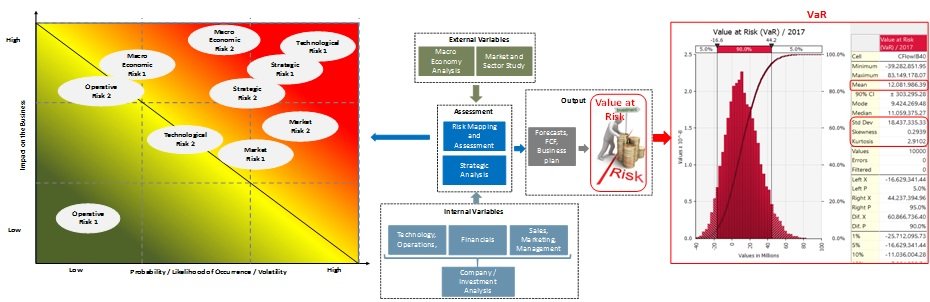

The figure in the next page shows our approach in the identification and measurement of value-risk drivers in order to arrive at the final output: The Value at Risk (VaR).

The figures

1 – we first analyse the business and its market, identifying risks and value drivers to build a value-risk flow as show in the centre of the figure above. Drivers are classify as external or internal and we analyse how and how much they can affect the business in the long term

2 – We then measure the probability of occurrence and volatility of variables and their impact in the business as shown in the risk map on the left of the figure above. Such measures are based on market studies.

3 – With this information, we create an advanced valuation model in excel but adding @Risk Palisade to run probabilistic and Monte Carlo Simulations.

4 – The output is a stochastic and rational driven forecast and free cash flow from which we obtain the value at Risk (VaR) as shown in the figure above on the right. The Value at Risk (VaR) measures the potential value of an asset over a defined period for a given confidence interval.

Some of the Benefits of this Approach:

1 – Value for Decision Making: The identification and measurement of external and internal drivers as well as their effect in your business in the short, medium and long term allows you to take strategic decisions. In our valuations, all possible scenarios are included with a clear and detailed picture of the market and its specific risks. We provide you with the tools for future value creation plan and risk management.

With this approach, investors and entrepreneurs can quantitively understand how the value is driven and decide how much risk and which risks they are willing to take.

2 – The best tool to mitigate Risk and Maximize Value

Our approach will show you the downside and upside risk of your business:

Downside risk is the probability of having a decline in the value of an investment or project if the market conditions change. Downside risk explains a worst case scenario for an investment or indicates how much the investor stands to lose. We use different metrics to estimate the likelihood that an investment’s value will decline, including historical performance and standard deviation calculations based on our advanced models and forecasts.

Upside risk is the probability of having an increase of value if the market conditions change.

With the help of computer vision technology and applications, we can track the different risk factors and value drivers involved in the business to improve the profitability of your business. We are able to determine which risk are more critical, when and how they could affect the business. As a consequence, we can support you in defining a strategy aimed at mitigating risks in order to maximize value.

https://bvint.com/private-equity-venture-capital-family-offices/