When & How Owners Should Start to Prepare a Firm for Sale

Some entrepreneurs wonder when they should start to prepare their company for sale. If it is a start-up business, the answer is: The day they open the doors. If it is the purchase of an existing business, the reply is: The day they assume ownership.

In our experience, owners whom properly plan far in advance the sale of their company normally receive a much higher valuation in terms of the multiple relative to their earnings. Furthermore, in the planning process, they increase both revenues and earnings.

In order to achieve higher valuations, a company needs to have a long term view with a value perspective and consequently, owners must work on a strategic value creation plan starting from the first day a firm is acquired or a start-up is created.

Unfortunately, research has consistently shown that most small and medium sized enterprises (SMEs) do not engage in strategic planning leading to a decrease in the company’s performance. This is not only due to the owner/managers limited knowledge but also to the lack of perceived value in strategic planning.

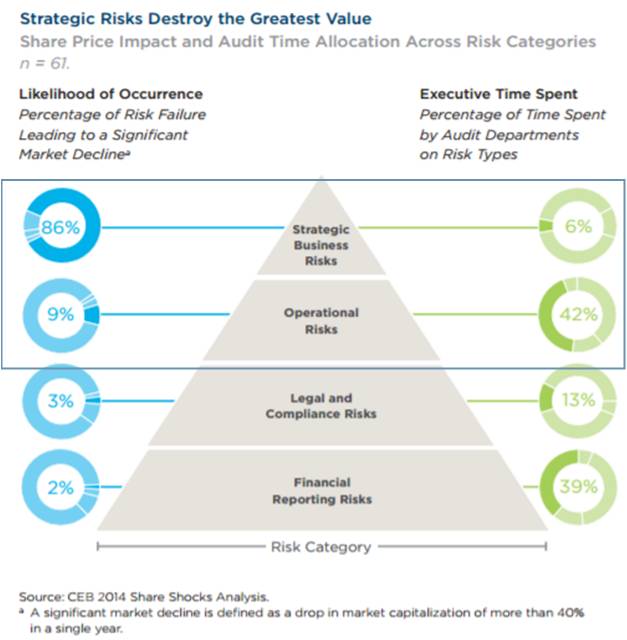

Risk assessment and attention has historically focused more than half its time on legal, compliance, and financial reporting functions. However, most big hits to shareholder value come from market, macro economic, strategic and operative risks.

Although, according to statistics, 86% of the hits in a business come from strategic risks, managers spend only 6% of their time in that area while they spend 52% of their time on legal, compliance, and financial risks. Still, many entrepreneurs hire only external accountants, tax experts, and lawyers and it is not common to see strategic and risk-value management consultants in a SME.

Decisions are mainly taken following entrepreneurs intuition. As a consequence, SMEs could underperform as they are not able to capture the best opportunities. The lack of value management could result in negative risk-return trade off which implies the destruction of value in the long term. Additionally, lack of strategic, risk, and value management causes SMEs to be unprepared to the fast growing changes in the market conditions.

When entrepreneurs decide to sell the company and they request our independent valuations (which include market, strategic, and advanced risk analysis), in most cases, we find that they are underperforming mainly due to the lack knowledge in areas of strategic, risk, and value management. As a result, they get lower valuations.

During a valuation process, entrepreneurs recognize the importance of measuring and mastering the risk and value drivers of the company and in most cases they ask us for periodical updates to monitor value creation.

The Value Creation Plan

The value creation plan is a strategic plan with a value perspective where each decision has a measurable impact on the value of the company.

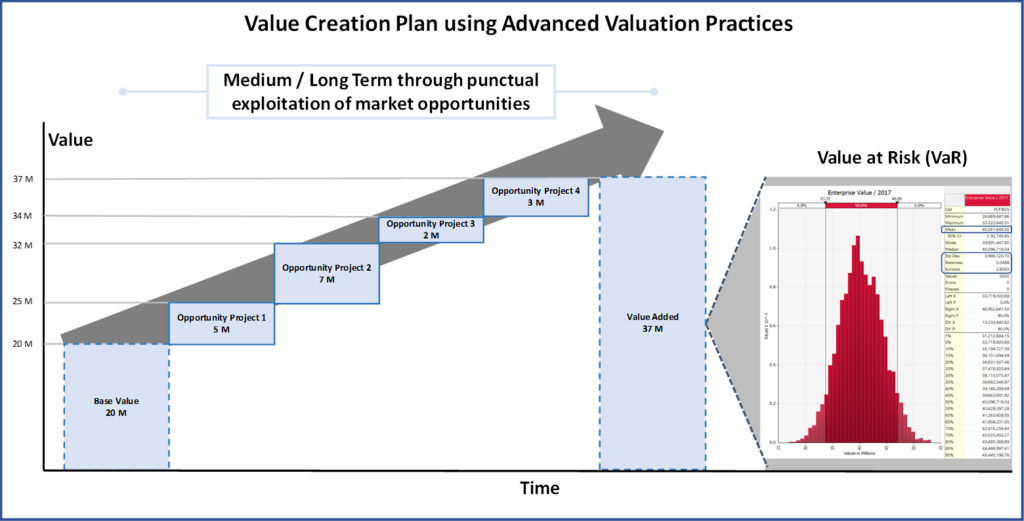

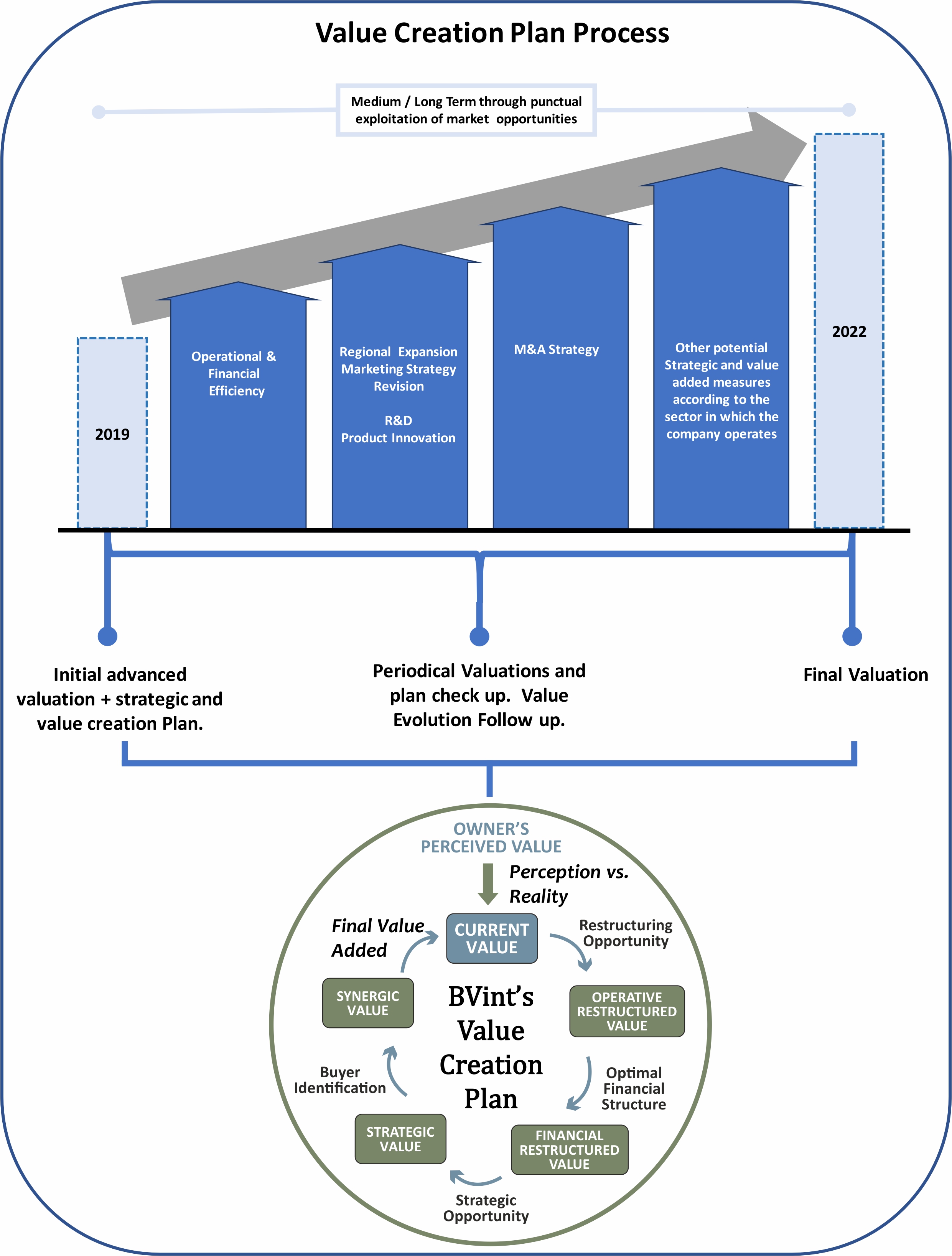

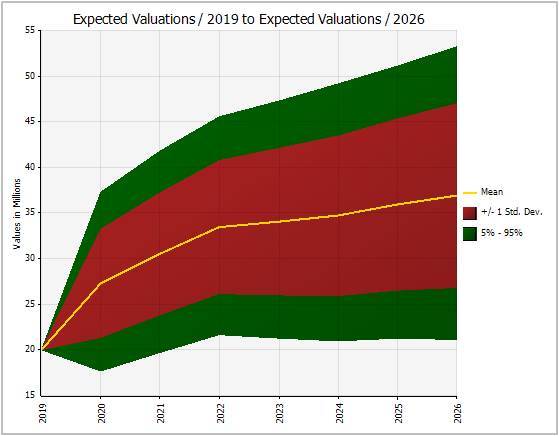

The process starts with an initial valuation of the company as it is, followed by a strategic plan and a new valuation which includes the strategic value. The strategic plan, the value of the firm, and its key drivers are then monitored periodically. All the process is detailed, with a sample, in the figure below.

The sample of the figure shows the value evolution of the company through the implementation of different projects in different areas which were previously assessed individually. Each project has its own forecast and risk (discount rate).

The value creation plan should answer the following questions:

- What is the value of your company today. Is your company creating value?

- Which risks are you facing? Do you know them? Have you measure them?

- Have you recently made a market study to identify new trends and opportunities? Have you assessed both opportunities and risks?

- Have you reviewed your strategy and business model in the light of the fast changing markets?

- Have you elaborated a strategy and business model with a concrete target where both value and risks are measured.

- Is your strategy capturing the best opportunities the markets are offering?

- Are your operations, technology and financial leverage aligned with a value added strategy?

The Value Creation Plan Process

i. The process starts with and advanced valuation which includes:

a. Analysis the company and markets.

b. Strategic positioning of the company.

c. Identification of both risk and value drivers.

d. Measurement of risk-value drivers using advanced analytics and probabilistic analysis (1).

e. Measure the impact of those drivers on the business.

f. Elaboration of a rational driven long term forecast.

g. Valuation in the frame of the firm’s present situation.

ii. Analysis of the Risks and Opportunities:

a. Operative and technological.

b. Restructuring.

c. Market: New Products, regions, channels, etc.

d. M&A.

e. Financial & Risk Mitigation

iii. Evaluation and Analysis of the implementation of the different opportunities identified.

iv. Business Model and Strategic Redefinition in the light of the previous analyses.

v. Elaboration of a business plan and value creation plan with a 5 years forecast to create and capture the value revealed by the chosen opportunities, projects and new strategy.

vi. New Valuation of the company considering a new strategic plan and value added business model.

vii. Quarterly valuations and follow up the of value creation plan and the market movements.

(1) Stochastic or random process is a probability model used to describe business phenomena that evolve over time. More specifically, in probability theory, a stochastic process is a time sequence representing the evolution of business variables / drivers whose change is subject to a random variation (Models containing a random element, hence unpredictable and without a stable pattern or order). Most businesses and open economies are stochastic systems because their internal environments are affected by random events in the external environment. Such situations need to be measured using probabilities, volatilities and standard deviations according to the profile of each variable under assessment.

Monte Carlo Simulation and Its importance in Valuation and Decision Making

Monte Carlo simulations are used to model the probability and volatility of different outcomes in a process that cannot easily be predicted due to the intervention of random variables. Since business and finance are plagued by random variables, Monte Carlo simulations have a vast array of potential applications in these fields. They are used to assess the risk that an entity will default and to analyze derivatives such as options. Insurers and oil well drillers also use them. Advanced Valuations also use them to assess all risks and variables driving the value of companies and investments. Sample of uncertain variables assessed by an advanced stochastic valuation:-

– Currency risk

– Interest risk

– Credit risk

– Probable contingencies and events,

– Commodity prices,

– Growth rates evolution,

– Markets, strategic, operative and technological risk-value drivers,

– Success probabilities to achieve certain targets,

– Start-up risks probabilities of success according to stage of development and sector,

– Etc.

– Stochastic Expected Value Forecast

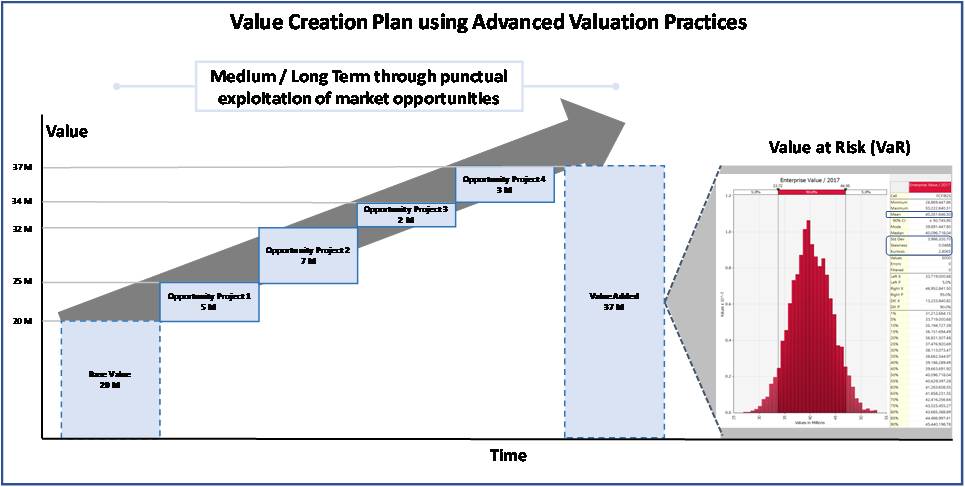

The value creation plan is a strategic plan with a risk and value perspective where each decision has a measurable impact on the value of the company. Both external and internal key value factors (identified during the company and market analysis) are subject to unpredictable variables driven by volatility or uncertain events.

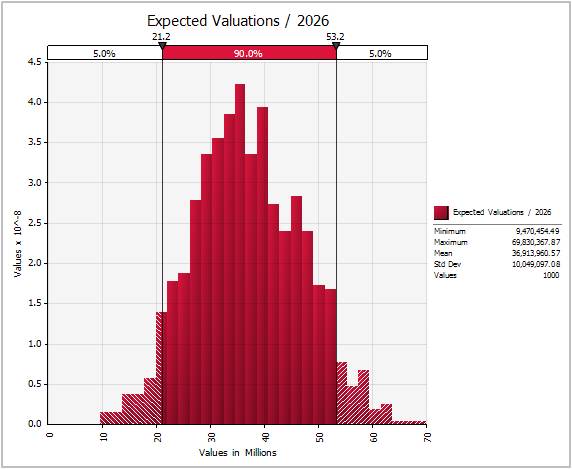

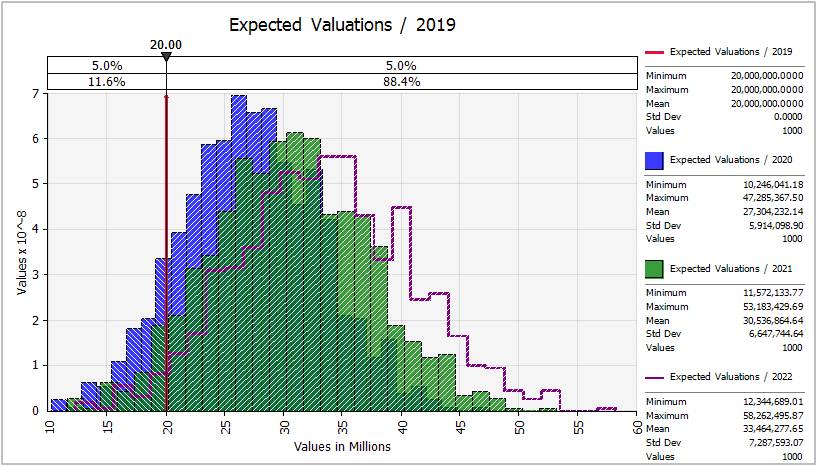

This is the reason why, each driver has a risk profile and is measured using uncertainty and probabilistic analysis. As a consequence, our outputs and forecast are stochastic (1) with a distribution of probabilities as shown in the figures. Each point in the surface of the graphs, corresponds to a particular scenario of probable events driven by external and internal factors.

In this way, managers know how each variable and risk included in a strategic plan could affect the value of the company. They can monitor the evolution of these drivers and improve decision making.

An Article with Real Cases Coming Soon

About the Author

Fernando Scarpati

Founder & Managing Partner of Business

Valuation International Ltd (BVint)

PhD in Valuation and Risk with more than 25 years in the Private Equity Sector and more than 500 valuations worldwide. He started his career in a top tier consulting firm continuing as Investment Director and Financial Service Director in important groups and PEs. He also holds an MBA, an Industrial Engineer degree and Bachelor’s degree in Economics and Business. As visiting Professor of business schools in Europe, he wrote many international articles in top financial journals and he is regularly interviewed and invited to speak at seminars and conferences. Fernando speaks fluent English, German, Italian and Spanish.