Our Products

Strategic Decisions and Value Balance Scorecard

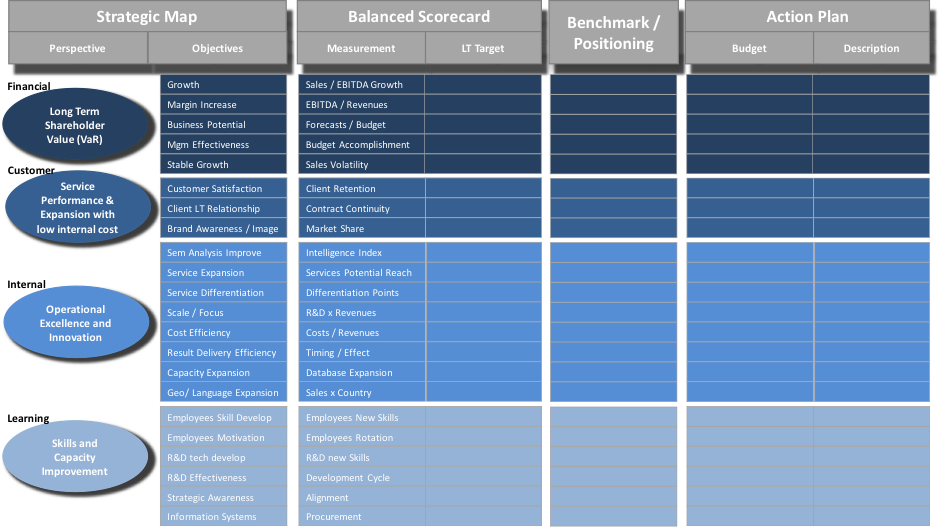

Our Advanced financial and strategic reporting / value balanced scorecard is aimed at measuring and monitoring the shareholders value of the company’s strategic decisions. It shows how the company’s value and strategy is affected by market changes and allows management to adjust decisions and anticipate shortfalls while planning long term value creation and by defining KPIs.

Our Advanced financial and strategic reporting / value balanced scorecard is the first stage of the Integrated Reporting Process aimed at measuring the value for shareholders, stakeholders and society. The phase one of the Integrated Reporting looks at the shareholder value which main target is to assist Companies, Shareholders and Stakeholders to monitor and create long term value by measuring the variables in all the dimensions of the business which go beyond traditional financial reporting. The final scope of this assignment is Decision Making and Value Creation:

- Long Term vs. Short Term Decisions: It will allow management to assess decisions, trade-offs and sacrifices into their business model.

- Integrated Thinking for Integrated Decisions: It leads to integrated decision-making and actions. It is the product of the processes of connectivity and integrated thinking in the organization. It is therefore not just about the report, but about the process of the organization’s unique approach to value creation.

- Valuation Decisions: Uncertainty in valuation, which can overvalue or undervalue an organization, can be lowered by increasing the amount of information available to shareholders. The ultimate goal is to enable investors to make more efficient and effective decisions and bring an organization’s market value closer to its intrinsic value.

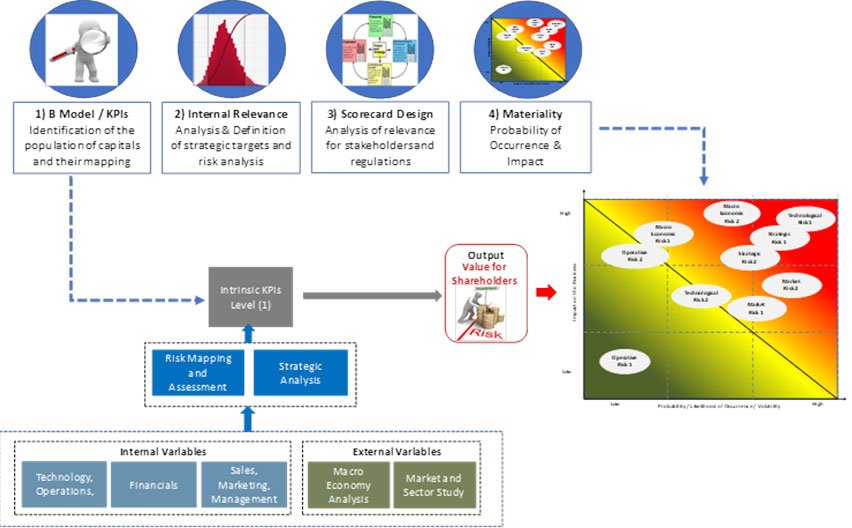

The Process and Phases:

- Definition of the business model lies at the heart of the balanced scorecard report.

- Strategy and key performance indicators: KPIs allow for quantification of value. They also provide the means for tangible and intangible assets to be measured, other than just monetary. When senior management determines the appropriate indicators, management can focus on monitoring strategic and material matters, while investors can assess value creation. It’s necessary to link measurable indicators and their impact on the organization’s tangible and intangible assets (such as brand, and customer relationships) that have a direct impact on shareholder value.

- Design and Definition of the Balance Scorecard: The design of the scorecard starts with the definition of the strategic goal of every perspective and the process is completed with the selection of the objectives and the performance drivers.

- Risk and opportunity management: This requires incorporating risk management into the organization’s decision-making process as well a strategy, then aligning it with prevailing industries circumstances. The goal is to reduce uncertainty with respect to the organization’s performance and future resilience.

- Definition of Materiality: A materiality assessment is crucial to ensure that the report focuses on the factors that significantly impact value creation now, and performance over the longer term. Determining what should be disclosed can be based on:

Relevance: Matters that have already impacted the organization’s strategy, business model or strategic capitals, or may do so in the future

Significance: An assessment of a matter’s significance and probability of occurrence

Prioritization: People charged with the organization’s governance need to prioritize the material matters based on their relevance and significance to investors.

Independent Follow Up Service

Elaboration of the periodic balanced scorecard report, we give you the following services:

- Support and advise during the elaboration of the periodic reports.

- Analysis of the outputs and opinion from an independent point of view

- Support in the definition of strategic and financial targets from an independent point of view.

- Modelling support at the base of the report.

Quick Links

Looking for a first-class business valuation consultant?

London

Berkeley Suite

35 Berkeley Square

Mayfair, London

W1J 5BF

Switzerland

Malta

6 Sir William Reid Street, Gzira, Malta

Contact Us

- +44 (0) 7443 758262

- info@bvint.com