Oil and Gas

Oil and Gas

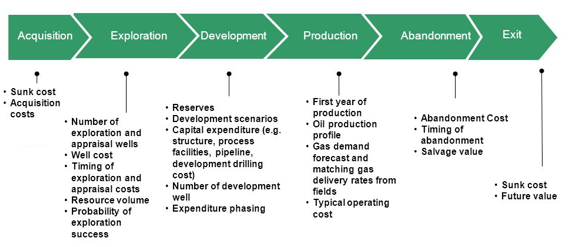

We offer many services to support the decision making process of the oil and gas sector. Our advanced Monte Carlo based techniques allow us to deliver strategic, economic and risk modelling solutions as well as advanced quantitative approaches, including:

- Exploration and discovery risk. We use probabilistic scenarios according to different studies, site location, well characteristics, etc.

- Drilling uncertainty, drill program planning. We reflect uncertainties in schedules, discoveries, and finance and resource constraints using probabilistic analysis based on history, statistics, prospects and previous studies.

- Schedule risk analysis and integrated cost-schedule risk modelling

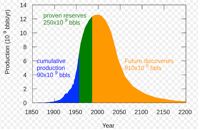

- Volumetric uncertainty estimation

- Price forecasting using volatilities and standard deviations based on history and market expectations

- Uncertainty analysis of all Macro economic and political scenarios that may affect the business (specially in emerging countries)

- Price limits and regulations in some countries are very important drivers to be considered. We analyse potential changes of those regulations and their impact in the business. Changes in regulation could affect the business positively or negatively and are mainly driven by political risk.

- Optimisation of resource deployment and of asset portfolios using kurtosis, skewness and standard deviation analysis.

- We use tools for complex decision-making like Monte Carlo Simulation, Real Options, and Bayesian techniques.

- Portfolio sizing and optimisation (e.g. optimal sizing of for E&A portfolios, aggregate reserves calculations)

- Integrated forecasting of all stages: Production forecasting and modelling (e.g. decline modelling, operational breakdown possibilities)

- We assess and forecast uncertain macroeconomic and political events that may affect both the price or the production of our forecasts.

- Business cases, valuation, and uncertainty modelling of new technologies (oil recovery, unconventional gas, wind, bio-fuels etc.)

- Financing issues (e.g. debt modelling, project finance, supporting of equity raises, use of non-conventional financing techniques)

- Advanced valuation techniques (combining cash flow, uncertainty analysis, real options, etc).

Sectors

Looking for a first-class business plan consultant?

London

Berkeley Suite

35 Berkeley Square

Mayfair, London

W1J 5BF

Switzerland

Rue de Genève 18

Case postale 306

1225 Chêne‑Bourg

Switzerland

Malta

6 Sir William Reid Street, Gzira, Malta

Contact Us

- +44 (0) 207 692 0877

- info@bvint.com