Our Products

Integrated Reporting

For Companies, Shareholders and Stakeholders looking to monitor and create long term value by measuring the variables in all the dimensions of the business which go beyond traditional financial reporting.

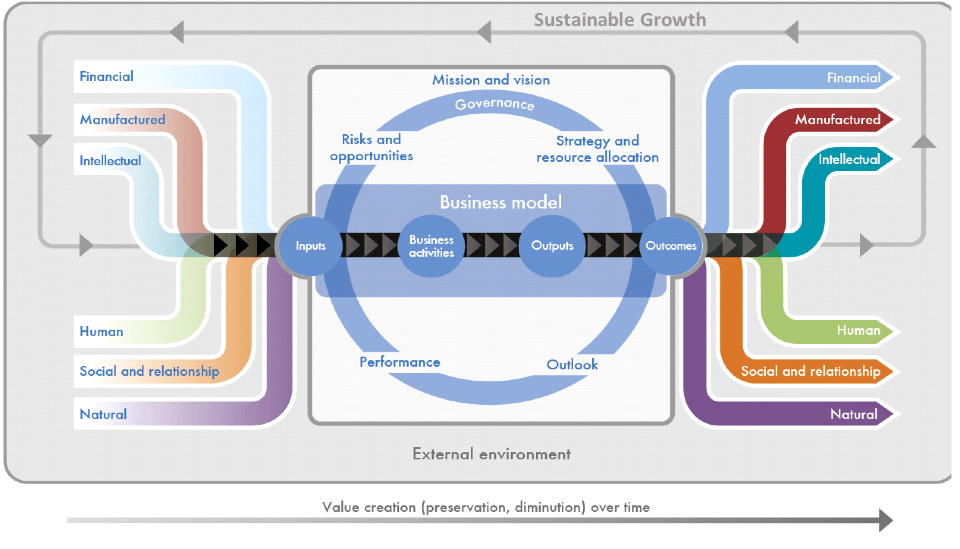

Integrated Reporting approach goes beyond the value reflected in the annual financial statements and includes the creation of intangible value and the impact of an organization’s activity on society as a whole. It also includes a measurement, or at least a description, of how these impacts influence long-term shareholder value and improve decisions accordingly.

Today, an organization creates value not only for its shareholders but also for the society as a whole by means of a sustainable strategy. This approach goes beyond the value reflected in the annual financial statements and includes the creation of intangible value and the impact of an organization’s activity on society as a whole. It also includes a measurement, or at least a description, of how these impacts influence long-term shareholder value.

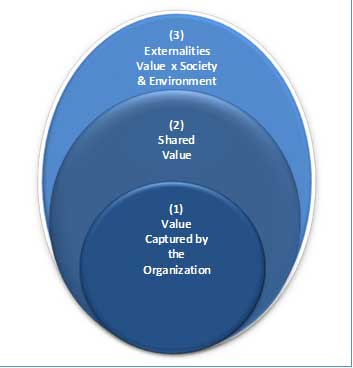

Sustainable organizations are expected to create value for society that go beyond returns for shareholders. Value that can be instrumental in improving an organization’s long term financial performance. We consider three levels in value creation (shown by the graph below):

Level 1: Shows the value currently measured by organizations usually through the annual report and accounts. This value is translated into dividends for shareholders or stock price gains.

Level 2: Refers to shared value benefiting stakeholders directly related to the organization (employees, customers, suppliers, public treasury, etc.). Shared value depends on factors such as employee performance, operating permits & consumer confidence.

Level 3: Describes the value generated by an organization for society, even if not directly linked to its business purpose. These externalities may be either positive or negative.

The final scope of the integrated report is to provide the company with the necessary tools to create value in the long term and it should tell how:

- It creates value and for whom

- It measures and quantifies the layers of value

- It identifies the value created at each level and how it may affect future performance.

Integrated Reporting for Decision Making and Value Creation:

I.Long Term vs. Short Term Decisions: Our Integrated Reporting will allow management to assess decisions, trade-offs and sacrifices into their business model. For example, for an organization to reduce its dependence on natural capital, it may have to sacrifice financial capital to invest in the human capital capable of achieving this goal. An organization may face the choice between protecting its financial capital in the near term and increasing its profit potential in the longer term. These decisions, if important, should be set out in an integrated report and defined in the organization’s value creation objectives.

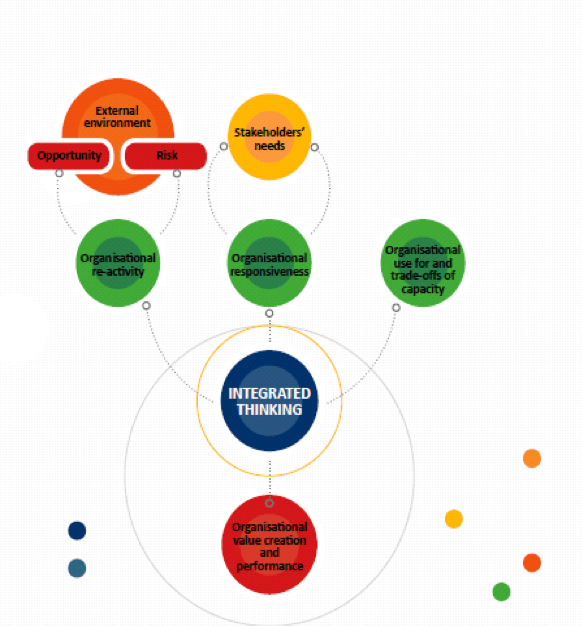

II.Integrated Thinking for Integrated Decisions: Our Integrated reporting leads to integrated decision-making and actions. The integrated report is the product of the processes of connectivity and integrated thinking in the organization. Integrated reporting is therefore not just about the report, but about the process of the organization’s unique approach to value creation.

III. Valuation Decisions: Uncertainty in valuation, which can overvalue or undervalue an organization, can be lowered by increasing the amount of information available to stakeholders. The ultimate goal is to enable investors to make more efficient and effective decisions and bring an organization’s market value closer to its intrinsic value. Integrated reporting does just that.

Quick Links

Looking for a first-class business valuation consultant?

London

Berkeley Suite

35 Berkeley Square

Mayfair, London

W1J 5BF

Switzerland

Malta

6 Sir William Reid Street, Gzira, Malta

Contact Us

- +44 (0) 207 692 0877

- info@bvint.com