Biotechnology and Pharmaceutical

Biotechnology and Pharmaceutical

We offer many services to support the decision making process of the Biotech and Pharmaceutical Industry during all its stages of development (fundraising, pre-clinical trial , clinical trial, commercial start up, early stage, mature stage, etc). Our advanced Monte Carlo based techniques allow us to deliver strategic, economic and risk modelling solutions as well as advanced quantitative approaches, including:

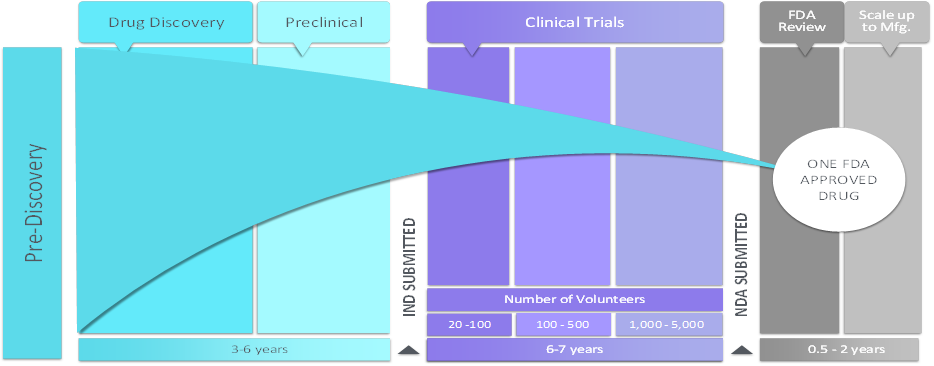

- Pharmaceutical and Biotech Start up projects need to consider the probabilities of each stage of the preclinical trial and clinical trial.

- We have a long experience in most disease area and manage updated and detailed data and statistics for each type of drug and treatment during the preclinical and clinical process.

- Our experience includes: Oncology, Neurology, Hematology, Infectious Diseases, Metabolic, Allergy, Endocrine, Urology, Autoimmune, Neurology, Cardiovascular, Psychiatry, Ophthalmology, Gastroenterology, Respiratory, etc. We also have a special focus on Monoclonal Antibodies, Immunotherapy, and Stem-Cells.

- We manager updated detailed information and statistics on recent projects for each disease area

- Creating clarity of cases being shown by existing plans, and of the true range of possible outcomes (e.g. for revenues, given the uncertainty both for established products, and those in development)

- Identify Risks in the portfolio of products of the pipeline

- Analyse and help to optimize risk mitigation during the clinical trial process.

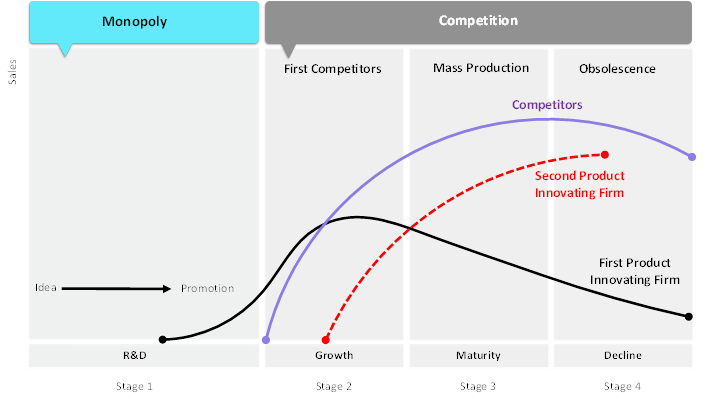

- We model the business events and distinctive phenomena that may arise during the life of the business. For instance, the graph below shows some typical forces present in the sector that need to be modelled using uncertainty and advanced probabilistic analysis in order to improve decision making:

- The launching of the new technology (shown by the black curve)

- After 2-3 years a new technology more efficient (violet curve) appears and threat to diminish both margins and sales.

- This threat must be offset by a continuous R&D strategy able to re-launch new technologies (red curve)

- The success rate (or probability of success of a given company) is driven by past records and know how

- When a client send us a business plan, we analyse the likely ranges for KPIs at a product, product group and portfolio level, and the likelihood that any base forecast or internal plan can be achieved e.g.

•How optimistic/pessimistic are these plans?

•What are the main reasons driving possible bias?

•What is the best way to allocate resources (and contingencies) to benefit from diversification and reduce resource-hoarding? - Financing issues (e.g. debt modelling, project finance, supporting of equity raises, use of non-conventional financing techniques)

- Advanced valuation techniques (combining cash flow, uncertainty analysis, real options, etc)

Sectors

Looking for a first-class business plan consultant?

London

78 York Street

London, UK, W1H 1DP

Switzerland

Rue de Genève 18

Case postale 306

1225 Chêne‑Bourg

Switzerland

Malta

6 Sir William Reid Street, Gzira, Malta